Adopt-A-DAP

Since the inception of CORESSWC, we have provided financial literacy and influence to over a dozen students in college and beyond. We are honored to provide our students the opportunity to earn more money to reduce their debt-ratio through supporters like you.

Adopt-A-DAP is a newly formed program, in which individuals can donate to an individual and institutions based on their background. Is a student from a specific region of yours? Same alma mater? Consider aiding to reduce their debt ratio today! No amount is small!

DAP Class of 2017

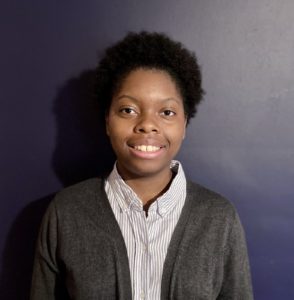

Julie-Ann Destine, DAP 2017, Smith College '21

Major: Education & Child Study

Minor: Psychology

Projected Loan Balance: $15,000

Hello! My name is Julie Destine, but you can call me Julie, and I am a senior at Smith College, where I study Education & Child Study and Psychology! I love to learning and sharing resources to me, and as a future counselor, I believe that this is something that I will be able to do with my students. Being a part of this program has provided numerous opportunities to learn, where 1) I grew in the skill of site development, 2) I grew in knowledge about financial literacy, and 3) I shared my experiences with those in my community.

Being a part of the program helped me realize how much I can learn from being financially literate at a young age. Learning from the mistakes and experiences of others allows me to navigate my finances as we speak! I learned about the impact of community with those who have achieved financial freedom and the role I have in obtaining that for myself.

Upon graduation, I should have $15,000 as an outstanding balance for loans, and being in this program will assist in paying back the loan in a reasonable time frame. With your help in aiding me to pay off my loans quickly, not only will I pay this forward, but I will also serve my community by teaching them about financial literacy and providing opportunities for them to grow as well. Thank you again! Enjoy your day!

Gabrielle Rodriguez, DAP 2017, North Carolina Agricultural and Technical State University Class of 2022

Majors: Criminal Justice & Psychology

Projected Loan Balance: $80,000

My name is Gabrielle Rodriguez and I am extremely excited to participate in the Adopt-a-DAP Program. To be sponsored is an awesome opportunity which is much needed. It would definitely help defray the cost of my college education. My total college debt upon graduation will be 80,000. I am majoring in Criminal Justice with a certificate in Forensic Science and minoring Psychology. Also, I will be graduating with the class of 2022. I am a rising junior, attending North Carolina Agricultural and Technical State University. Upon completion of my undergraduate studies, I will continue on to graduate school to obtain my master’s and then, my PhD. My goal is to start making a difference in the world. I will continue to put God first and help as many people as possible along the way.

As I get older, I know that financial literacy is extremely important. Between the knowledge I’ve acquired in school, my mother and asking questions, I learned and am happy to say that I am financially literate. I know that I still have a lot to learn; but I’m well on my way. To me, there are three main aspects of financial literacy. The first is budgeting. As college students, we have a pretty good idea of how much money we receive each month. Create a budget of your income and expenses and STICK TO IT; that way, you know where every penny of your money goes. The second aspect is to save. Every month, a portion of the income you receive should be saved AND NOT TOUCHED. You would be amazed at how fast your account grows if you never withdraw from your account. Of course, there are many different savings/investment options to choose from. The last aspect is to minimize or eliminate debt. I have one credit card which I make a small purchase every three month to help build up my credit. It would be ridiculous to charge items on a credit card and not be able to pay the full balance when it’s due. Paying interest is throwing away money. I have learned a lot over the last few years about financial literacy and I intend to continue soaking up as much information as possible. CORESSWC is a tremendous organization which does so much for so many. I know that Financial Literacy is extremely important to this organization. I thank everyone who played a role in making this opportunity possible.

DAP Class of 2018

Jacques Clovis, DAP 2018, Stevens Institute of Technology Class of 2022

Major: Mechanical Engineering

GPA: 3.08

Projected Loan Balance: Over $30,000

Upon the end of my college career, I will have loans totaling over $30,000. Having immigrated to this country in 2011, my goal has always been to give back to my community and especially my parents for providing me with such an amazing opportunity to receive a great education and the chance to succeed in America. Although I am currently studying as an engineer, my ultimate goal in life is to work anywhere where I will be able to impact the lives of many people because throughout my twenty years of life so far, people have always been there for me.

As a first-place winner in the DAP Program in 2018, financial literacy was never an interest as I had little to no exposure to it. Schools are not going to teach the important things in life such as taxes, financial independence, creating a bank account, finding a job, manners, relationships, etc. Therefore, when I had the opportunity to be part of a program that opened my eyes to financial literacy and the chance to exit college debt-free, it was not even a choice as much as a non-negotiable. This program has changed my thinking completely and reignited the flames that keep me motivated towards that bright future I want to have.

As a result, having a sponsor in this program will help quite a lot towards my goal of leaving college debt-free, in turn, making it easier to pursue my dreams in life. My plan is to continue to work tirelessly in order to keep myself accountable towards those who invest time and money in my education.

Rashawn Green, DAP 2018, Rutgers University Class of 2022

Major: Chemical Engineering

Projected Loan Balance: $20,000

My name is Rashawn Green. I am a sophomore at Rutgers University-New Brunswick (RU RAH RAH), where I am currently enrolled in the prestigious Rutgers-School of Engineering as an undergraduate pursuing a Bachelor of Science Degree as a Chemical Engineering major. Upon completion of my 4-year degree at Rutgers, I plan to utilize the skills, experiences, and connections I have acquired to hone my craft and bolster my skill set with the intent of creating my own business in the future.

Born into less than ideal circumstances, I understood early on the immense value of money and the importance of education. Using my environment and experiences as both learning tools and reasons to strive for better, I sought to maximize my likelihood of success by prioritizing education. Through my pursuit of academic success, I was able to find my passion and position myself to make my dreams a reality. It is a great pleasure to be a part of the Adopt-a-DAP program. This amazing program will help I and many others pursue our academic careers by lessening our financial burden and allowing us the opportunity to grow and continue the legacy by extending a helping hand to others. Thank you so much for this wonderful opportunity!

Enoca Jones, DAP 2018, Howard University Class of 2022

Major: Communications

Projected Loan Balance: $28,000

Hello, my name is Enoca Jones. I am a rising sophomore, Communications major, with a focus in film and television at the illustrious Howard University. I was fortunate enough to be selected as the first place winner of the FRASA award my junior year in high school, and a runner up my senior year. Being a part of the DAP program has emphasized the importance of financial literacy in my life, and has aided in defining what it looks like for me as an individual. I believe I am a financially literate individual who is not only aware of how to manage their wealth, but also how to accumulate and maintain it. I grew up in a household where education is held in high regard, and my parents taught me that knowledge is power and what you do with this power is just as crucial as attaining it. For this reason, I desire to use the wisdom I gain to improve the condition of my community, specifically within the entertainment industry.

As a young woman of color, I only see a handful of successful black faces in the media. Moreover, those that I do see, are largely unrecognized by the Academy of Motion Pictures and Sciences. In addition, the narratives of people of color lack adequate representation within mainstream media. I believe that by diversifying this industry, we not only add people from contrasting walks of life, but we also add the diverse perspectives they carry with them. Furthermore, an influx in minority voices within the content creation process, will ensure that marginalized groups receive suitable representation, and will increase the diversity of the narratives that we see.

No amount of research on a culture can substitute for the perspective that someone from that demographic can bring. Therefore, the need for diversity in the field of film and television is paramount. I seek to be the change I wish to see in this field by filling this need and producing diverse content tailored around the experiences of black people.

However I can not achieve this goal without the proper funding. Subsequent the completion of my college education, I will have accumulated around a total of 28,000 dollars in student loan debt. This debt will pose an immense prohibitor for me in obtaining my future goals in the media industry. It is common knowledge that creators in this field do not make comparable entry-level wages to college graduates in other fields. Therefore, being the scholar you chose to adopt will not only assist me in the process of quickly and efficiently paying off my debt, but you will also be helping me uplift my community, and in turn the world around me. .

DAP Class of 2019

Reneé Dews, DAP 2019, Bloomfield College

Major: Education

Projected Loan Balance: $91, 730

My name is Reneé Dews and I am a sophomore at Bloomfield College. I am currently in their new 5-year Masters of Education program! I also go to school for acting as that has also been a lifetime dream of mine. Upon completion of school I plan on being able to teach grades from PreK-12 while also pursuing my career in acting!

Growing up and especially now that I’m in college, I realize how much financial literacy has a big impact on myself and how very important it is. I learned that every cent counts and make sure to use it wisely. As being a part of the DAP program, I also learned that investing in yourself and your education is the best thing to do because no one can take that degree from you!

I am honored to be a part of the Adopt-a-DAP program. I believe this is an amazing opportunity and a great way to help me, as well as other college students, with college debt and be able to focus more on our careers and futures!

Total College Debt Estimate = $91,730

(Based on current Spring semester fee of $9,173)

Star Lawson, DAP 2019, Penn State University

Major: Biobehavioral Health

Minor: African-American Studies

Projected Loan Balance: Approximately $130,000

My name is Star Lawson, I am an 19 year old second year student at The Pennsylvania State University. I am currently majoring in Biobehavioral Health on a pre-med track and soon to be minoring in African American Studies! At school I participate in a mentoring program for underrepresented students called BLUEprint and M.A.P.S. which is an organization made for minorities who are pre-health. Currently, I am a New Student Orientation Leader for Penn State introducing over 15,000 students to PSU so far! I love helping others in need and anything to do with mental health that's why I aspire to become a Pediatric Psychiatrist!

I believe being sponsored will help me tremendously because already having a large sum of loans for my first year of undergraduate and this is only to double as I go onto Medical school. My estimated debt upon exit should be $130,000. Being able to lessen this burden takes a lot off my shoulders and mind of how I might pay back these large amounts so I am able to focus more on my studies! Thank you so much for this amazing opportunity!

Alieke Parrish, DAP 2019, Howard University Class of 2023

Major: International Business

Projected Loan Balance: TBD

My name is Alieke Parrish. I am a rising sophomore Honors International Business major at Howard University. I was inducted into the Documentary Awards Program in 2019. Currently, the money I am earning in the CORESSWC FRASA program enters an entrepreneurship and real estate account that I will gain access to upon graduation. Having funds to invest or start a business with when I finish my undergraduate education leaves me a clear advantage over my peers, as real estate is one of the few assets that only appreciates as time passes. Knowing that this account awaits has lead me to put thought into what I plan to do with it. In addition to this, I am reimbursed for all of the textbooks that I have had to purchase for school. This has been especially helpful, as textbooks often cost between $100 and $300.

-Alieke Parrish, Howard University ℅ 2023

Trish Elleston, DAP 2020, Temple University Class of 2024

Major: Neuroscience

Projected Loan Balance: TBA

Hello Everyone! My name is Trish Elleston and I am currently a freshman at Temple University. I am pursuing a Bachelor of Science degree in Neuroscience and I will graduate in the spring of 2024. Upon completion of my Bachelors, I plan on getting my Master’s and pursuing a career in Forensics or I may go to medical school and become a pediatric radiologist.

I became very interested in financial literacy at a young age. I had a deep love for finances and wanted to discover a path that would lead me to financial freedom. With the help of my family members, I have been able to learn about various tips and tricks that will make my money grow over time. My profound passion for financial literacy has helped me learn to save and also inspired me to open up a ROTH IRA account at the age of 17. Upon entering junior year of high school, I anticipated college being a large expense for myself and my family. Therefore, I made a personal goal to myself to graduate from college debt-free. The CORESSWC FRASA and DAP program are actively helping me reach my goal by awarding me with their first place award and various opportunities to lessen my school expenses.

DAP Class of 2020

Trish Elleston, DAP 2020, Temple University Class of 2024

Major: Neuroscience

Projected Loan Balance: TBA

Hello Everyone! My name is Trish Elleston and I am currently a freshman at Temple University. I am pursuing a Bachelor of Science degree in Neuroscience and I will graduate in the spring of 2024. Upon completion of my Bachelors, I plan on getting my Master’s and pursuing a career in Forensics or I may go to medical school and become a pediatric radiologist.

I became very interested in financial literacy at a young age. I had a deep love for finances and wanted to discover a path that would lead me to financial freedom. With the help of my family members, I have been able to learn about various tips and tricks that will make my money grow over time. My profound passion for financial literacy has helped me learn to save and also inspired me to open up a ROTH IRA account at the age of 17. Upon entering junior year of high school, I anticipated college being a large expense for myself and my family. Therefore, I made a personal goal to myself to graduate from college debt-free. The CORESSWC FRASA and DAP program are actively helping me reach my goal by awarding me with their first place award and various opportunities to lessen my school expenses.

Brielle Hunter, DAP 2020, The College of New Jersey Class of 2024

Intended Major: Psychology

Projected Loan Balance: TBA